Home | Learn | Mortgage 101

Mortgage Insurance – Why do I need to have it and what is it good for?

Jason Kauffman | March 15, 2022

Mortgage insurance is one of the more misunderstood potential costs associated with obtaining or carrying a mortgage and gaining a better understanding of it could save you money.

What is mortgage insurance? Who is it insuring?

Simply put, mortgage insurance is insurance that protects your mortgage lender in the event that you default on your loan and they have to foreclose on your home. Foreclosures cost lenders money. On average they cost the lender $40,000-$50,000 in lost interest, attorney’s fees, realtor commissions, insurance and tax payments, potential equity loss, etc.

So the mortgage insurance that you as a homeowner pay, protects the lender in the case you can’t make your payments.

Well why would I pay for something that protects the lender when I’m already paying them interest for the loan!?

A fair question. And the answer requires looking back in time at early home ownership and financing in America. Prior to 1934, homeowners in America had to come up with 50-80% down payments, and the loans that they received had terms of 3-5 years with balloon payments at the end of the term. Only 4 in 10 Americans owned a home at that time and the only financing available was private.

After 1934 the federal government began offering home loans through the Federal Housing Administration (FHA). These loans allowed for lower down payments at the time (10-20% down). As the FHA captured more of the mortgage market, the private banks became more willing to compete in the space FHA was operating in.

Private mortgage insurance was introduced by MGIC in 1957. The notion being that a borrower could put less than the customary 20% down payment and purchase insurance from a private company that protected the lender’s higher risk position due to a lower down payment.

The end result was that more people with less money down were able to obtain financing for a home purchase than otherwise would’ve been able to without mortgage insurance companies defraying the risk for the lenders so that they were comfortable to lend on lower down payments.

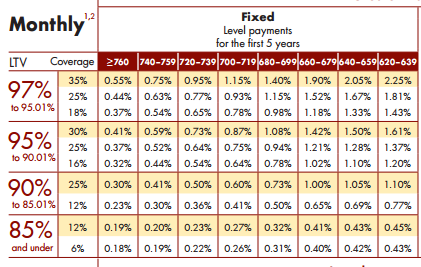

Private Mortgage Insurance rates are tiered by credit score and down payment. The more money you put down and the better your credit score, the lower the mortgage insurance rate. Below is an excerpt from Radian’s borrower paid MI chart showing how the tiering works:

The PMI chart above differs significantly from the FHA mortgage insurance chart. The goal of the FHA has always been expanding homeownership for Americans. So naturally there are no adjustments for credit score, just for down payment and loan term.

It is these reduced mortgage insurance rates that make FHA such a viable alternative to conventional financing for borrowers that have less than perfect credit. The interest rates are typically lower than conventional rates as well. One downside to FHA is that there is a 1.75% mortgage insurance premium that usually gets financed in your loan, as well as the fact that except for a few exceptions, you will pay mortgage insurance for the life of the loan.

The good new with conventional loans and private mortgage insurance is that it will eventually drop off your mortgage. On a 30 year loan it takes 10-11 years with a minimal down payment (3-5%).

So it’s important to talk to a mortgage professional about what your options are with regard to mortgage insurance. The most common type of mortgage insurance is monthly. Another option to consider is lender paid mortgage insurance. This happens through a large cost on the front end of your loan to essentially “buy out” the mortgage insurance for the life of the loan, lowering your monthly payment.

Any time you look at lender paid mortgage insurance you have to make sure the breakeven on the cost to buy it out matches your intentions on how long you will keep the home (cost / monthly savings = number of months to breakeven).

The point of this article is to introduce you to the concept of Mortgage Insurance, help you understand its purpose, and how it differs depending on the type of loan you are seeking. A thorough analysis from a mortgage professional will help you understand which loan and type of mortgage insurance might be best for your situation.

Get the pre-approval process started today!

Jason Kauffman

Jason Kauffman is one of the owners of Uptown Mortgage and a licensed mortgage originator. He is a veteran in the mortgage industry with over 20 years of experience helping people get financing on their homes. The same experience that he brings to his clients is what he brings to the mortgage content that he produces. His goal is to help educate current and prospective homeowners on subjects that are relevant to the homebuying process.

NMLS # 199088